“That being said, the form may require employees to remember specifics from their most recent tax return to properly fill out the form and avoid any issues. “While the updated form may initially elicit some confusion for employees, these important changes will ultimately simplify the ability to set and adjust withholding to achieve desired results, such as a specific tax refund amount,” Pete Isberg, vice president of government affairs of ADP, said in a statement. Incorrectly filling out the new W-4 form could result in similar complications for employees moving forward. The new form is for use this year – it is intended to make withholding more accurate in conjunction with the Tax Cuts and Jobs Act, which affected filers for the first time last tax season.Īmid those changes, many workers were surprised about their refund amounts – whether they were lower or even non-existent. If you have any further questions about your withholding, please contact your tax advisor or refer to. Please be advised that Rice’s payroll team cannot provide tax advice nor advise employees on tax withholdings.

The IRS has also published Frequently Asked Questions that you may find helpful as you complete the form. The best option is to determine the additional withholding amount, using the withholding estimator and enter that amount in Step 4(c). The IRS takes your privacy seriously and suggests that, if you are concerned about reporting income from multiple jobs in Step 2 or other income in Step 4(a), you may simply check the box in Step 2(c), which will divide the standard deduction equally between two jobs or enter an additional withholding amount in Step 4(c).

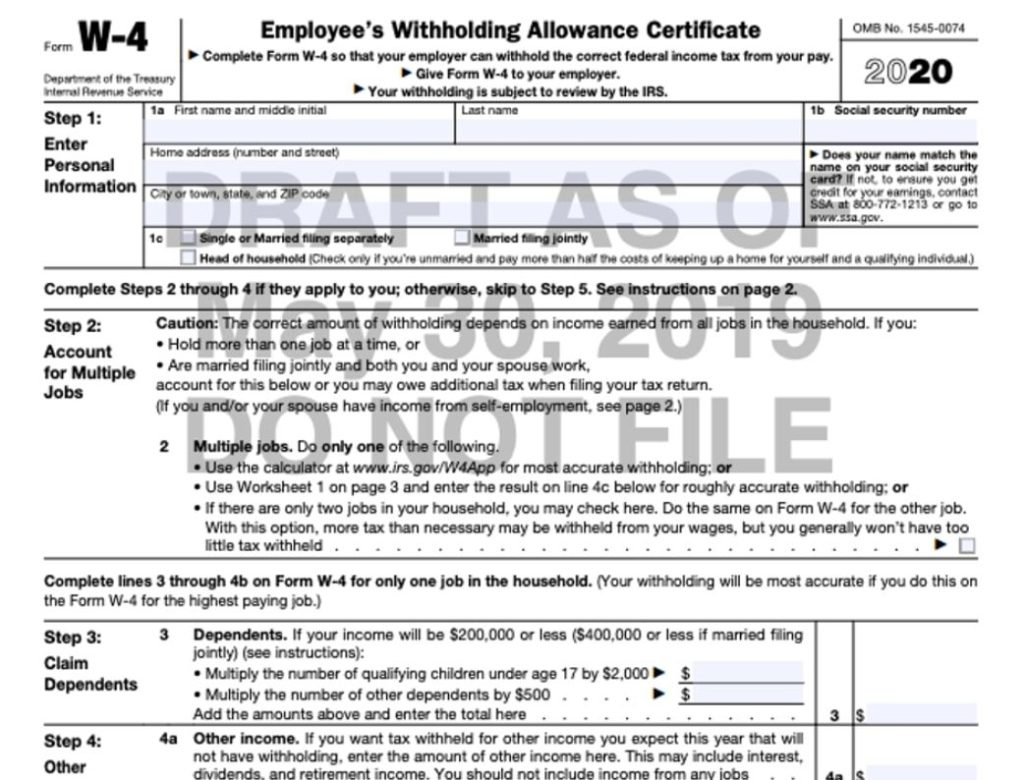

If you determine that you need to change your withholding, please make necessary changes to your Form W-4 within ESTHER under Employee > Tax Forms. Please note: If you do not submit a new W-4 form, withholding will continue based on your previously submitted form. The IRS Tax Withholding Estimator is the recommended tool and individuals may find it helpful to have a copy of their most recent pay stub and tax return available for reference. However, certain employees will be required to use the new form - those hired in 2020 and anyone who makes withholding changes during 2020.Įven though the IRS does not require all employees to complete the revised form, the IRS recommends individuals to perform a “paycheck checkup” to determine if changes to current withholding are necessary – even if there are no changes to individual tax situations. The Internal Revenue Service (IRS) is not requiring all employees to complete the revised form and has designed the withholding tables so that they will work with both the new and prior year forms. Youve had a recent personal or financial change that may affect your tax situation, such as a change in your income, filing status, or number of dependents. This is due to the federal tax law changes effective back in 2018. The 2020 Form W-4, Employee’s Withholding Certificate, is very different from previous versions.

0 kommentar(er)

0 kommentar(er)